The Weekly Forecast Monitor is a forward-looking assessment of geopolitical dynamics shaping our world. To get more in-depth analysis of these issues and learn more about analytical products from New Lines Institute — including simulations, training sessions, and forecast reports — contact us at [email protected] and visit https://newlinesinstitute.org/analytical-products/. Download PDF Version.

Listen to the WFM podcast here

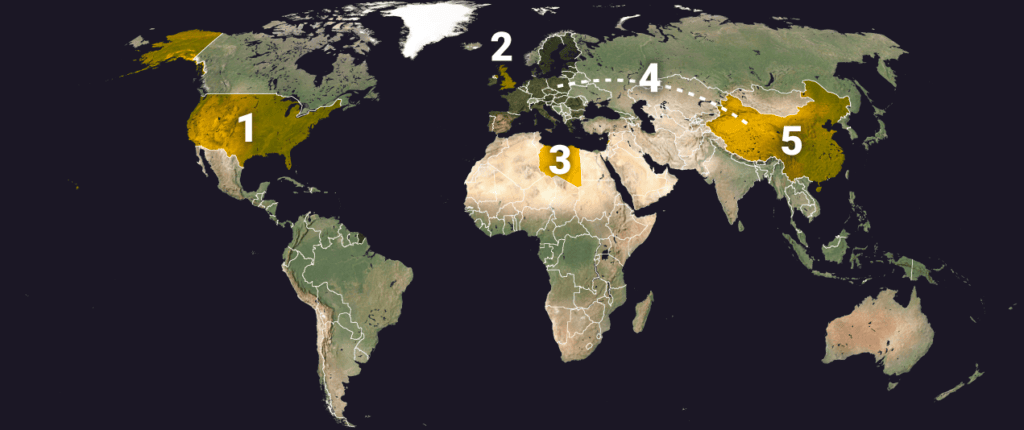

Global Hotspots

The Global Hotspot Tracker examines the outlook for key geopolitical hotspots around the world. (Go to the Global Connectivity Tracker)

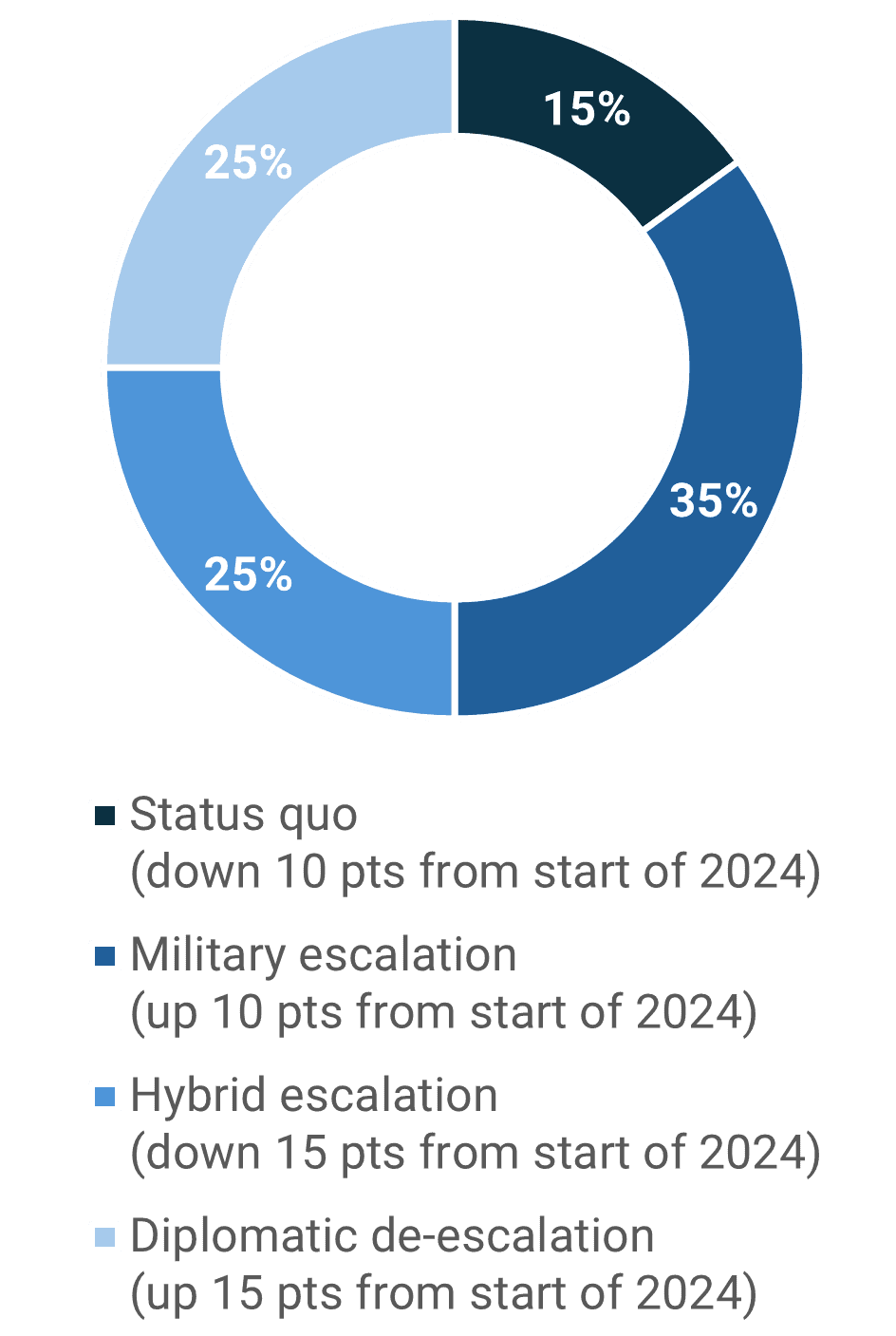

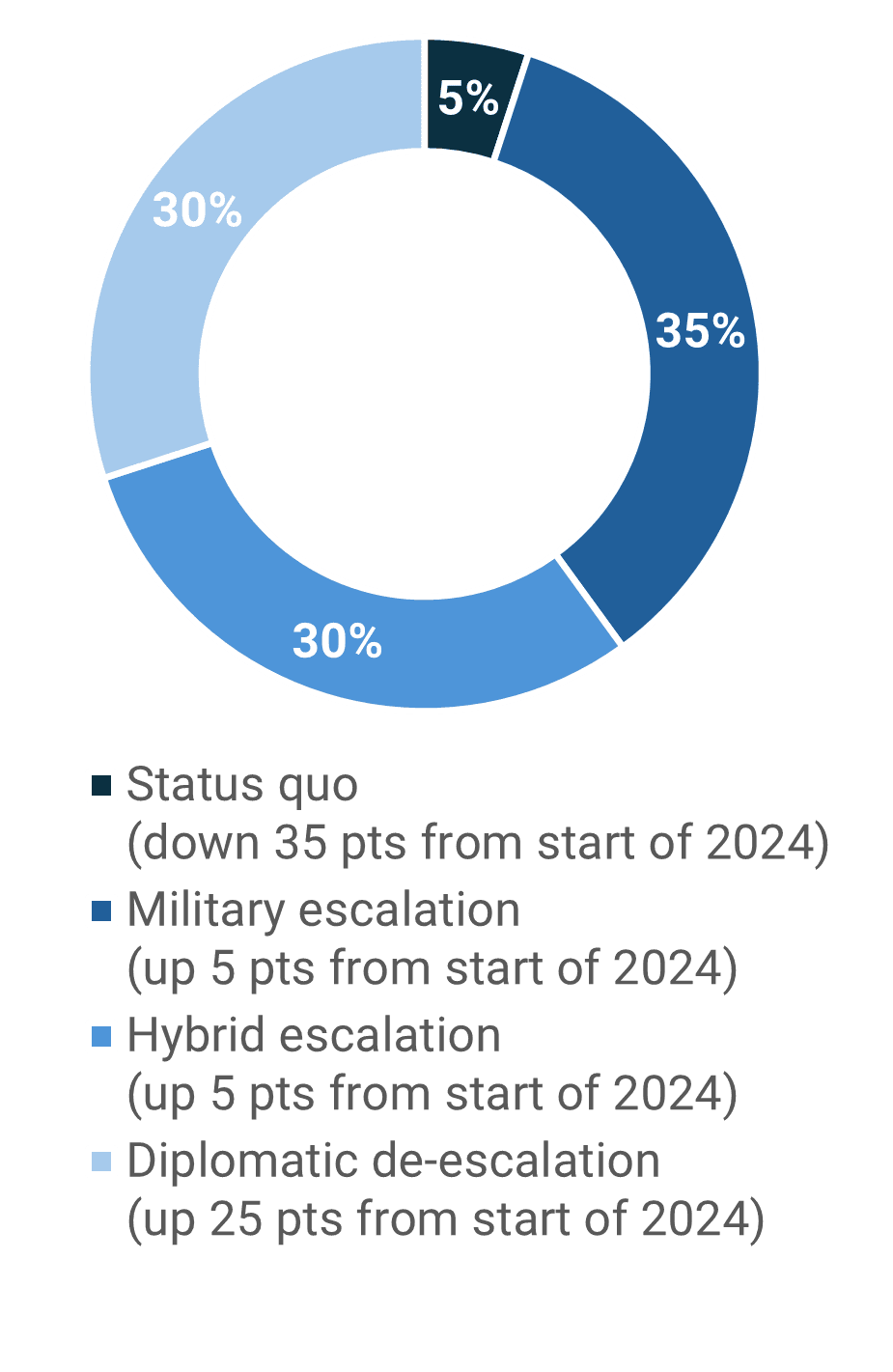

Russia/Ukraine Conflict

Summary – The Russia-Ukraine conflict trended toward military escalation and diplomatic de-escalation scenarios as Ukraine expanded its incursion into Russia’s Kursk region and attacked border posts near Belgorod. Russia advanced toward Pokrovsk in Donetsk and fired missile and drone barrages throughout Ukraine. Ukrainian President Volodymyr Zelensky expressed interest in India’s hosting a second peace summit.

Military escalation scenario

- Ukrainian officials claim its forces control 1,300 square kilometers of Russian territory and have captured nearly 600 Russian soldiers as its Kursk incursion continues. Ukrainian forces launched ground attacks against Russian border posts in Belgorod.

Risk level – medium - Russian forces continue to advance toward Pokrovsk in Ukraine’s Donetsk oblast as Russia launched repeated large-scale drone and ballistic missile attacks against cities throughout Ukraine.

Risk level – medium - Zelensky announced the domestic development of a new ballistic missile, as well as the drone-launched “Palyanitsya” missile.

Risk level – medium

Hybrid escalation scenario

- Chinese officials said they intend intention to circumvent new U.S. sanctions following allegations that Chinese companies are supporting Russia’s war effort.

Risk level – low/medium

Diplomatic de-escalation scenario

- Zelensky expressed interest in a second peace summit with India as host. Russia stated no preconditions exist that would prevent peace talks.

Opportunity level – medium - Russia and Ukraine have agreed to exchange 115 prisoners of war each after negotiations hosted by the United Arab Emirates.

Opportunity level – low

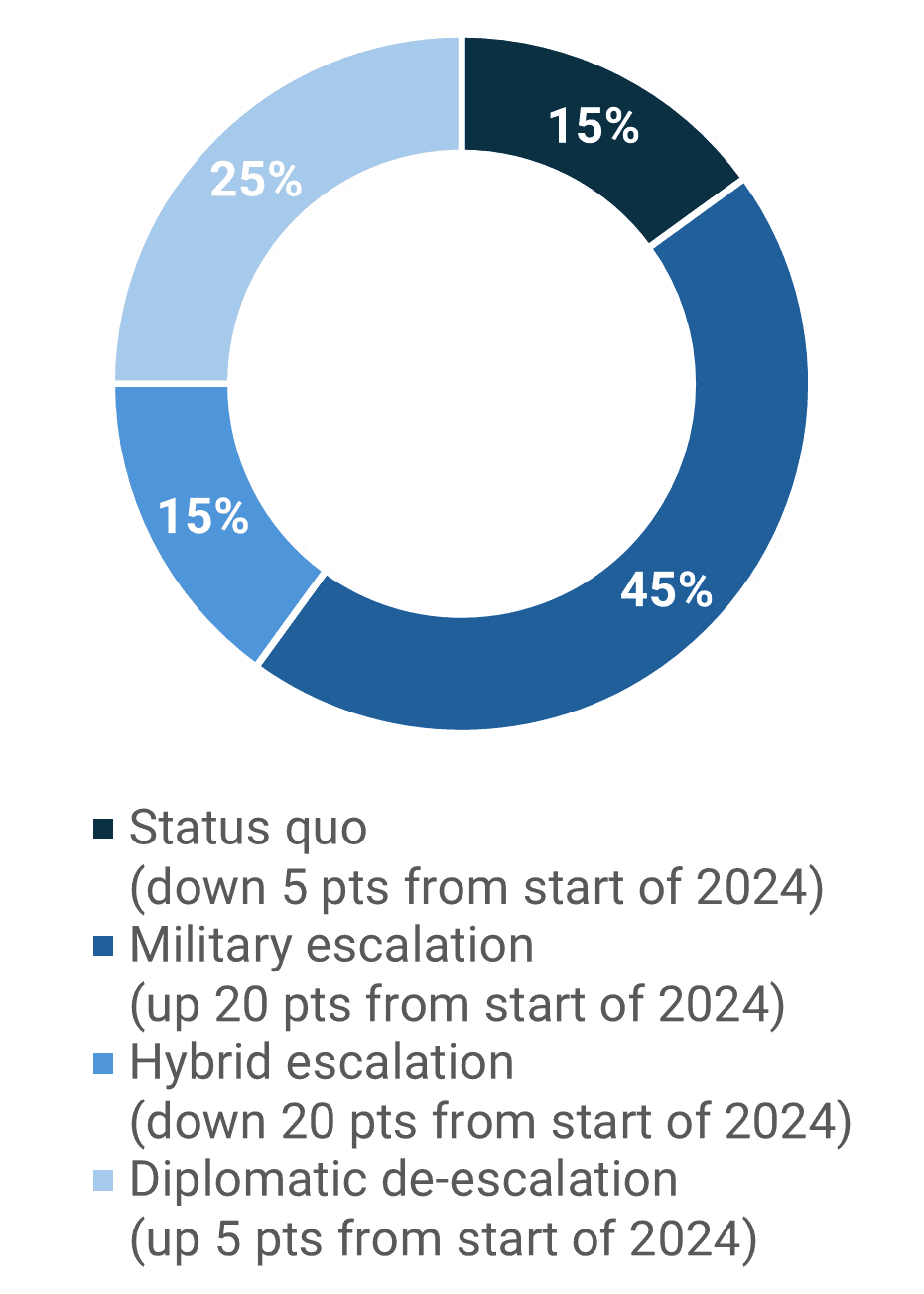

Middle East

Summary – Tensions in the Middle East trended toward military escalation and diplomatic de-escalation scenarios as Israel opened a large-scale operation in the West Bank and exchanged cross-border strikes with Hezbollah in both Lebanon and Syria. Recent mediations between Israel and Hamas faltered, while Iran signaled general openness to discussions with the U.S. over its nuclear program.

Military escalation scenario

- Israel initiated a large-scale counterterrorism operation in the West Bank, primarily centered in Tulkarm and Jenin. An Israeli airstrike killed five people in the Nur Sham refugee camp in the West Bank, an escalatory departure from typical Israeli security operations in the area.

Risk level – medium/high - High-intensity Israeli airstrikes continued inside Gaza, resulting in dozens of Palestinian casualties.

Risk level – medium - Israeli airstrikes targeted Hezbollah rocket positions in Lebanon, preempting retaliatory strikes by the group following the recent killing of a senior Hezbollah commander. Hezbollah struck positions in northern Israel.

Risk level – medium

Hybrid escalation scenario

- EU High Representative for Foreign Affairs Josep Borrell is leading an initiative for member states to sanction senior Israeli leaders, specifically Finance Minister Bezalel Smotrich and National Security Minister Itamar Ben-Gvir.

Risk level – low - Al-Houthi rebels will allow a European Union task force to salvage a tanker carrying 1 million barrels of oil that had been damaged Aug. 21 by an al-Houthi attack in the Red Sea.

Risk level – low

Diplomatic de-escalation scenario

- Mediators in Cairo failed to reach consensus over conditions for a Gaza cease-fire, primarily due to contentions over post-conflict control of the Philadelphi Corridor.

Opportunity level – low/medium - Iranian Supreme Leader Ali Khamenei said he is open to negations with the United States over his country’s nuclear program but cautioned his government that the U.S. was not to be trusted.

Opportunity level – low/medium

U.S./China/Indo-Pacific

Summary – Tensions in the Indo-Pacific trended toward a diplomatic de-escalation scenario, as U.S. National Security Advisor Jake Sullivan met with Chinese diplomatic and military officials in Beijing. A Chinese reconnaissance plane breached Japanese airspace for the first time. Belarus and China vowed to increase security and economic ties.

Military escalation scenario

- A Chinese Y-9 surveillance plane breached Japanese airspace for the first time, prompting Japan to scramble fighter jets. The Chinese Foreign Ministry claims the incident was unintentional.

Risk level – medium - Personnel at a Chinese island base in the South China Sea fired flares at a Philippine fisheries bureau plane.

Risk level – low/medium - U.S. Navy Adm. Samuel Paparo expressed openness to naval escorts of Philippine ships traveling through the South China Sea in an effort to prevent further clashes with China.

Risk level – low/medium - The U.S. Department of Defense is seeking congressional approval to expand the role of special forces to provide training and equipment to allied nations, including Taiwan.

Risk level – low/medium

Hybrid escalation scenario

- Belarus and China issued a joint statement vowing to strengthen their security and economic ties.

Risk level – medium - U.S. cybersecurity firm Lumen Technologies reported that the Chinese hacking group Volt Typhoon had compromised the security of several U.S. internet companies.

Risk level – low/medium

Diplomatic de-escalation scenario

- Sullivan concluded a three-day visit to Beijing, where he and his Chinese counterparts discussed several issues affecting bilateral relations, including Taiwan, tariffs, counternarcotics, artificial intelligence, and improved inter-military communication.

Opportunity level – medium - U.S. President Joe Biden and Chinese President Xi Jinping plan a telephone meeting in the coming weeks.

Opportunity level – medium - Trade relations between China and India are improving as India’s tech industry has been pushing for import restrictions to be lifted, and Chinese investment into India appears to be rising.

Opportunity level – low/medium

Global Connectivity

The Global Connectivity Tracker examines the sectoral impact of geopolitical dynamics on key themes like the global energy/climate transition, trade, and technology. (Go to the Global Hotspot Tracker)

- United States: Electricity Generation

What happened: More than 4 gigawatts (GW) of battery storage capacity were added to the U.S. electric grid in the first half of 2024, making it one of the fastest growing components of utility-scale generation in the country over that period.

Significance/Outlook: Construction of solar energy facilities accounted for 12 of the total 20.1 GW of new capacity added to the U.S. electric generation portfolio since January, according to a preliminary report from the U.S. Energy Information Administration. Over 90 percent of the new battery capacity came online in California, Texas, Arizona, and Nevada. Batteries can store electricity generated by renewable and other sources for use in balancing supply and demand when conditions are not favorable for renewable generation.

Opportunity level – medium - United Kingdom: Energy

What happened: U.K. energy prices are set to rise on Oct. 1 due to extreme weather conditions and global geopolitical tensions.

Significance/Outlook: The rising cost of energy has had a significant effect on U.K. households, particularly those with low incomes. The volatile global natural gas market, influenced by international conflicts, has driven up energy prices in the U.K., which is particularly vulnerable to geopolitical price shocks. In addition, record-breaking heatwaves and violent storms in recent years have boosted electricity and natural gas demand. Climate change has made weather patterns less predictable, making it harder for energy providers to maintain stable prices and increasing customer energy costs.

Risk level – low/medium - Libya: Oil

What happened: Eastern Libya’s government said it will halt oil production and exports until further notice due to a central bank crisis.

Significance/Outlook: The shutdown of Libya’s main revenue source follows the Tripoli-based Presidential Council’s dismissal of central bank governor Al-Siddiq Al-Kabir, causing economic panic. In response, a local group in the Al Wahat region, Libya’s largest oil-producing area, halted oil production, demanding fair wealth distribution before reopening the fields. This action might return Libya to its pre-Geneva political agreement state, posing significant security and political risks. The closure of eastern oil fields, which account for nearly two-thirds of Libya’s output, effectively halts exports. Oil markets reacted with a 3% increase in prices, placing the U.S. and Western nations in a precarious position amid sanctions on Russia.

Risk level – high - China/EU: Trade

What happened: China has launched an antisubsidy campaign targeting dairy products imported from the EU between March 2023 and April 2024.

Significance/Outlook: China’s Ministry of Commerce opened an investigation into subsidy mechanisms by the EU for its dairy products exported to China. The 12-month investigation will focus on 20 subsidy programs in eight member states, namely Austria, Belgium, Croatia, the Czech Republic, Finland, Ireland, Italy, and Romania, as well as mechanisms under the EU’s Common Agricultural Policy. The announcement comes after the European Commission’s decision to impose 36% tariffs on imports of Chinese electric vehicles (EVs) following a nine-month investigation that found China to be unfairly dumping cheap EVs into the EU market, threatening domestic production. The EU has expressed fears that a trade war with China is unavoidable.

Risk level – low/medium - China: Nuclear Energy

What happened: China has approved the construction of 11 nuclear reactors across five regions, marking a record number of permits granted at once.

Significance/Outlook: This move underscores the government’s reliance on nuclear energy to drive emissions reductions and transition to cleaner energy sources. The total investment for these 11 reactors is estimated at nearly $41 billion, with construction expected to span five years, according to state-run China Energy News. With 56 reactors currently in operation and 30 under construction (with an expected capacity of 32,203 megawatts), China leads the world in nuclear construction capacity, according to the Nuclear Energy Association. Notably, Beijing has approved 10 new reactors in just the past two years, further solidifying its commitment to expanding nuclear energy infrastructure. For China, integrating more nuclear power into its energy mix is essential for reaching net-zero targets in the coming decades.

Opportunity level – high

Key Stats of the Week

- The closure of oil fields costs Libya around $100 million per day.

- Libya’s oil production was about 1.18 million barrels per day in July, according to OPEC.

- Libya’s economy relies heavily on oil and gas, which account for 97% of its exports, over 90% of its fiscal revenues, and 68% of its GDP.

Source: African Development Bank Group