The Weekly Forecast Monitor is a forward-looking assessment of geopolitical dynamics shaping our world. To get more in-depth analysis of these issues and learn more about analytical products from New Lines Institute — including simulations, training sessions, and forecast reports — contact us at [email protected] and visit https://newlinesinstitute.org/analytical-products/. Download PDF Version.

Listen to the WFM podcast here

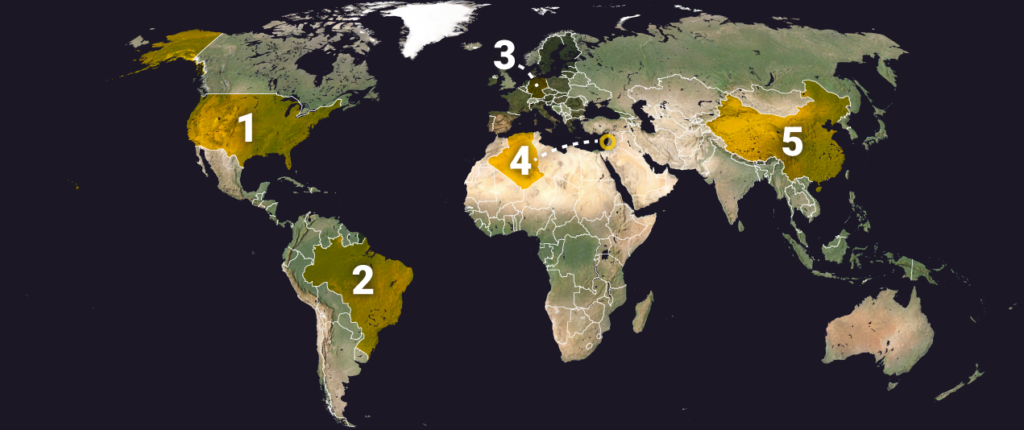

Global Hotspots

The Global Hotspot Tracker examines the outlook for key geopolitical hotspots around the world. (Go to the Global Connectivity Tracker)

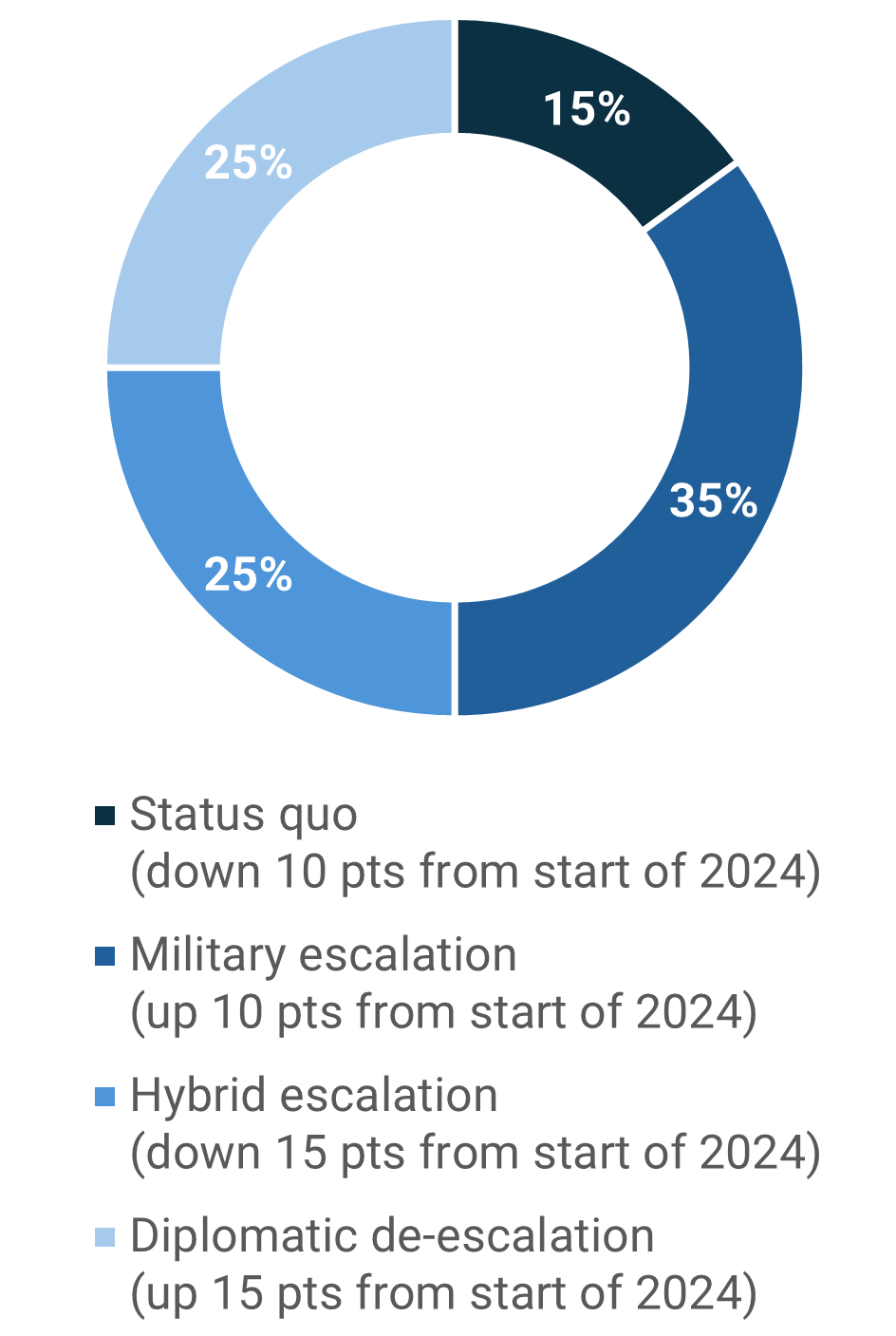

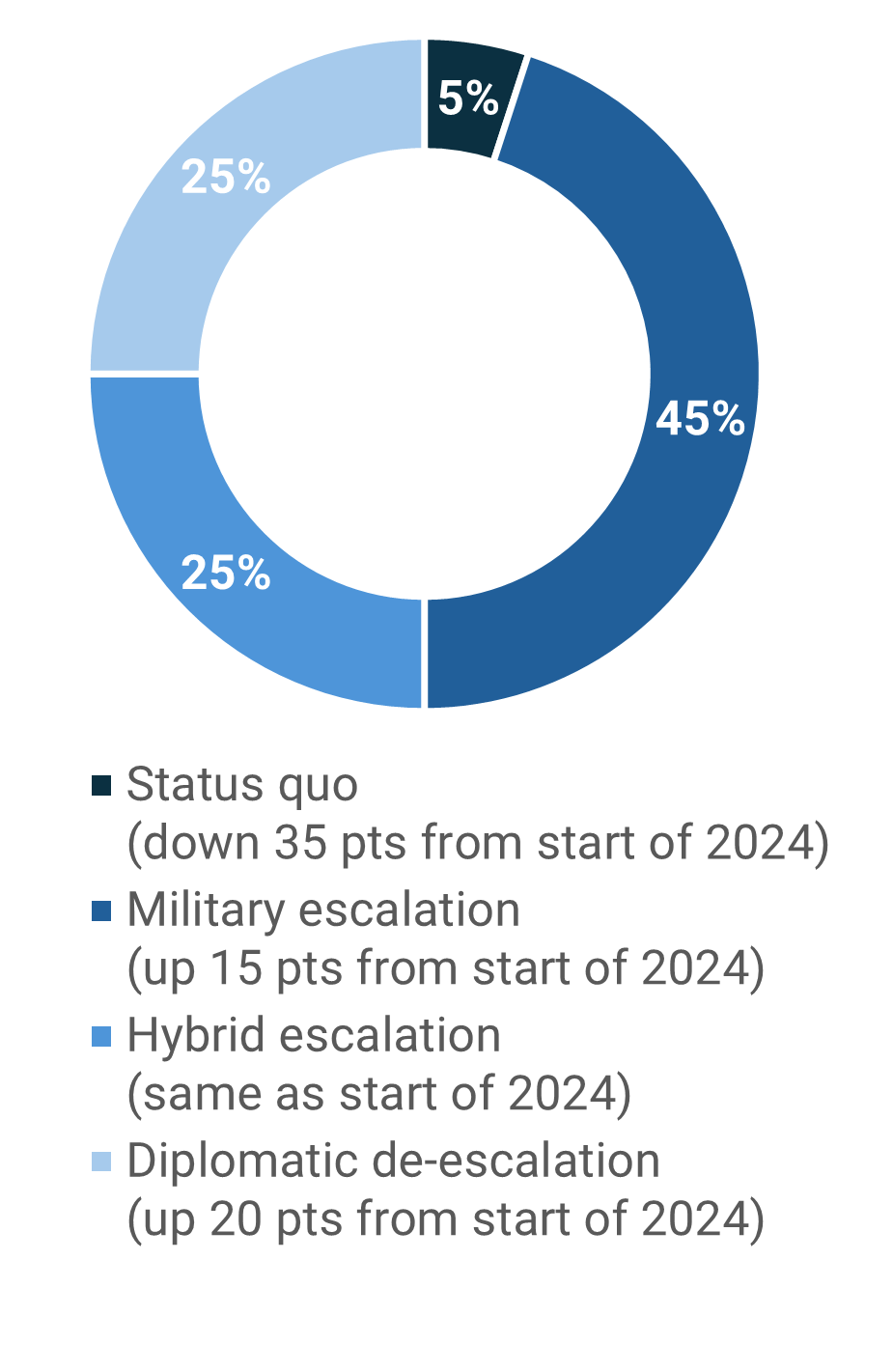

Russia/Ukraine Conflict

Summary – The Russia-Ukraine conflict trended toward a military escalation scenario as Ukraine continued its incursion into Russia’s Kursk region and conducted one of its largest drone attacks in Russia. Russia continued its push in Donetsk. Indian Prime Minister Narendra Modi visited the region to promote cease-fire talks.

Military escalation scenario

- Ukrainian forces continued their incursion into Kursk, destroying several bridges used by Russia to supply its troops. Ukraine’s military command said it controls more than 1,150 square kilometers of territory.

Risk level – medium - Russia continued its advance toward the town of Pokrovsk in the eastern Ukrainian region of Donetsk. Russian forces captured the town of Zalizne.

Risk level – medium - Ukraine carried out one of its largest drone attacks in Russian territory since the start of the war, with Russia shooting down 45 drones, including in the Moscow region.

Risk level – low/medium

Hybrid escalation scenario

- The Czech Defense Ministry said it would use interest earned from frozen Russian assets to buy artillery shells for Ukraine.

Risk level – medium

Diplomatic de-escalation scenario

- Russian presidential aide Yuri Ushakov said Russia will not hold peace talks due to Ukraine’s Kursk incursion but that it has not withdrawn earlier peace proposals.

Opportunity level – low - Modi visited Poland and Ukraine to try to reinvigorate peace talks.

Opportunity level – low/medium

Middle East

Summary – Tensions in the Middle East trended toward military escalation and diplomatic de-escalation scenarios as Israel and Hezbollah exchanged rocket and drone attacks along the Israeli-Lebanese border, while a Fatah commander was killed in Lebanon for the first time. U.S. Secretary of State Antony Blinken’s tour in the Middle East did not lead to a cease-fire agreement, though Iran indicated that its retaliation against Israel could be “calibrated” to avoid disrupting a potential pause in hostilities.

Military escalation scenario

- Israel and Hezbollah continued to exchange rocket and drone attacks. Israeli Defense Minister Yoav Gallant said the military would shift its focus to the fight with Hezbollah after the Rafah Division of Hamas had been “defeated.”

Risk level – medium - An Israeli airstrike in the southern Lebanese city of Sidon killed a member of Fatah, the first such time that the party of Palestinian President Mahmud Abbas had been targeted in Lebanon.

Risk level – medium - Hamas and Islamic Jihad claimed responsibility for a suicide bomb blast in Tel Aviv that killed the attacker and injured a passerby.

Risk level – medium - Israel continued its offensive in Gaza with several missile strikes. The Israeli military said the bodies of six hostages were recovered in the city of Khan Younis.

Risk level – low/medium - Iran’s mission to the United Nations issued a statement that its retaliation against Israel would be “carefully calibrated to avoid any possible adverse impact” on a cease-fire.

Risk level – low/medium

Hybrid escalation scenario

- Palestinian officials accused Israeli banks of refusing to accept shekel cash transfers from Palestinian banks in the West Bank, which could prevent Palestinians from accessing critical goods and services.

Risk level – low/medium - An al-Houthi rebel attack on a Greek-flagged oil tanker in the Red Sea led to the rescue of 25 crew members.

Risk level – low

Diplomatic de-escalation scenario

- Blinken said Israeli Prime Minister Benjamin Netanyahu had accepted a “bridging proposal” to narrow gaps between Israel and Hamas but concluded his tour of the Middle East without a cease-fire agreement.

Opportunity level – low - Egyptian officials expressed skepticism of the U.S. bridging proposal, saying “the Americans are offering promises, not guarantees” regarding a permanent cease-fire by the Israeli side if Israeli hostages in Gaza are returned. Egypt also insisted on the withdrawal of Israeli forces from the Gaza-Egypt border.

Opportunity level – low

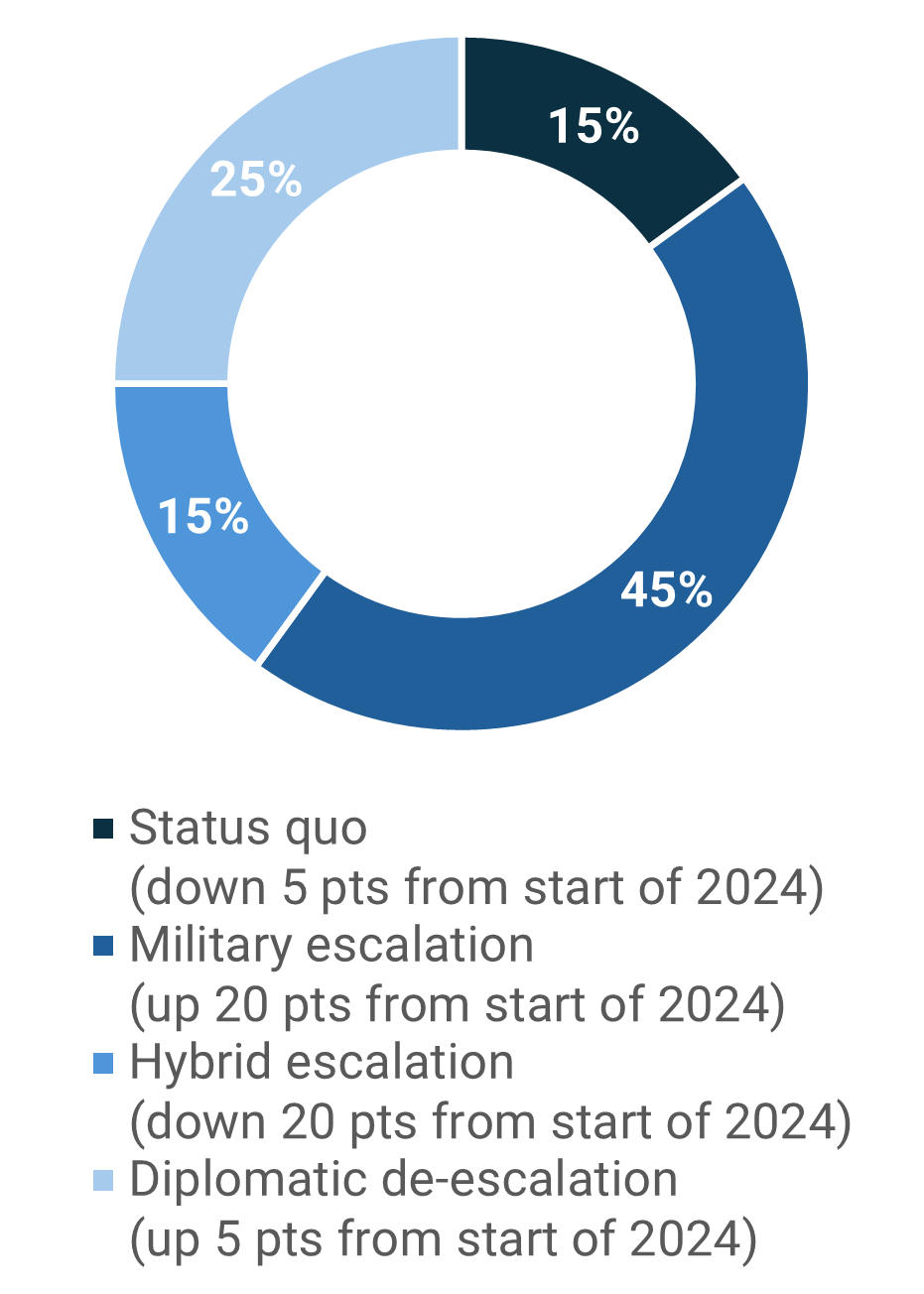

U.S./China/Indo-Pacific

Summary – Tensions in the Indo-Pacific continued to trend toward a military escalation scenario as China held joint military exercises with Thailand, signed agreements with Vietnam on increasing defense cooperation, and conducted maritime patrols near Japan and Taiwan.

Military escalation scenario

- China and Thailand conducted their most complex “Falcon Strike” joint military drills to date, with a shift in focus from counterterrorism operations to conventional warfare.

Risk level – medium - China’s National University of Defence Technology’s College of Aerospace Science and Engineering has developed a cost-effective way to reduce missile overheating and missile flight time over long distances, including over the Pacific, during hypersonic flight.

Risk level – medium - A collision between a Philippine and Chinese vessel near the Sabine Shoal sparked warnings and accusations from both sides.

Risk level – medium

Hybrid escalation scenario

- The Australian Senate passed a motion affirming that U.N. Resolution 2758, which recognized the People’s Republic of China as the legitimate government of China, does not establish that government’s sovereignty over Taiwan.

Risk level – medium - Beijing will launch an anti-subsidy investigation into dairy products imported from the EU between April 2023 and the end of March 2024, a response to the EU’s increasing trade regulations against Chinese electric vehicles.

Risk level – low/medium - Chinese Premier Li Qiang he met with Russian President Vladimir Putin and Prime Minister Mikhail Mishustin in Moscow to sign agreements on increased bilateral investment and cooperation.

Risk level – low/medium

Diplomatic de-escalation scenario

- Chinese President Xi Jinping met Vietnamese President To Lam to sign 14 deals strengthening trade and border connectivity.

Opportunity level – low/medium - Russian Deputy Foreign Minister Sergei Ryabkov met his Chinese counterpart, Ma Zhaoxu, in Beijing to discuss the war in Ukraine, vowing that both parties are committed to promoting “global peace and security.”

Opportunity level – low - Recent large-scale Chinese investments into Türkiye and announcements by President Recep Tayyip Erdoğan of possible reciprocal state visits point to a warming of relations after years of diplomatic stonewalling.

Opportunity level – low

Global Connectivity

The Global Connectivity Tracker examines the sectoral impact of geopolitical dynamics on key themes like the global energy/climate transition, trade, and technology. (Go to the Global Hotspot Tracker)

- United States: Wind/Coal

What happened: Wind power in the United States surpassed the production of coal-fired generation in both March and April of this year, a milestone for the expansion of renewable power in the U.S. energy mix.

Significance/Outlook: Several factors are behind the shift, including government incentives to build out renewable power, technological developments that make renewables cheaper, and state and federal mandates to phase out coal-burning power plants. Since 2000, the capacity of coal-fired generation has been cut in half while wind energy has increased 60-fold. Additionally, many coal plant operators take generation units offline in April, typically a time of lower electricity demand.

Opportunity level – medium - Brazil: Hydroelectric

What happened: Brazil temporarily shut down two of its major hydroelectric power units amid severe drought and low water levels in the Madeira River.

Significance/Outlook: With the shutdown, Brazil must increase its reliance on thermal power plants, which are more expensive to operate, and import electricity from neighboring countries such as Argentina and Uruguay to offset the domestic production decrease. Droughts in 2023 caused a dramatic decline in hydropower generation globally, including in China, the U.S., and Brazil, which have increased risks to energy security and could cause certain countries to expand their output of fossil fuels and increase global emissions to make up for the shortfall.

Opportunity level – low - Germany: Climate

What happened: The 40 largest companies in Germany listed on the blue-chip DAX index lowered their greenhouse gas emissions by 14% in 2023.

Significance/Outlook: The companies collectively lowered their carbon footprint from 218 million tons of CO2 equivalents to 189 million tons, according to their sustainability reports. The German economy is making substantial progress in reducing CO2 emissions, with companies switching to renewable energy sources and reducing energy consumption through conservation and efficiency measures.

Opportunity level – low/medium - Algeria/Lebanon: Energy

What happened: Algeria announced it will begin supplying 30,000 tons of fuel oil to Lebanon for its power plants amid power outages there.

Significance/Outlook: Algeria is primarily recognized for its natural gas reserves, but it also produces oil and is a member of OPEC. Algerian President Abdelmadjid Tebboune informed Lebanese Prime Minister Najib Mikati that Algeria is willing to support Lebanon by immediately supplying fuel oil to power the plants and restore electricity in the country. Lebanon has been experiencing power shortages since the 1990s, largely due to continuous government financial distress. Lebanese public utility Electricité du Liban said in a statement that its fuel supplies were exhausted leading to nationwide power outages. This happened after the last operating production units at the Zahrani Power Plant, the country’s last functioning power generation facility, shut down due to a lack of fuel. Essential facilities were affected nationwide, such as Rafic Hariri International Airport, the Port of Beirut, and water pumping stations.

Risk level – medium - China: Critical Minerals

What happened: In September, China will restrict its exports of critical minerals, including antimony ores and oxides, as well as critical mineral processing equipment.

Significance/Outlook: While Beijing states these restrictions are not aimed at a particular country, it follows recent restrictions and sanctions imposed by the U.S. against Chinese entities producing and distributing dual-use technologies. China’s antimony mining production has also fallen considerably over the past several years, suggesting that in addition to being a responsive policy to U.S. sanctions, it may use the resources for its own weapons and semiconductor industries. The U.S. likely will respond by increasing imports from countries such as India and Oman and increasing its domestic mining and refining capabilities.

Risk level – medium

Key Stats of the Week

- Brazil generated 91% of its electricity in 2023 from clean sources: 60% from hydropower, 21% from wind and solar, and 10% from other clean energy sources.

Source: Ember