The Weekly Forecast Monitor is a forward-looking assessment of geopolitical dynamics that are shaping the international system. To get more in-depth analysis of these issues and learn more about analytical products from New Lines Institute — including simulations, training sessions, and forecast reports — contact us at [email protected] and visit https://newlinesinstitute.org/analytical-products/. Download PDF version.

Global Hotspot Tracker

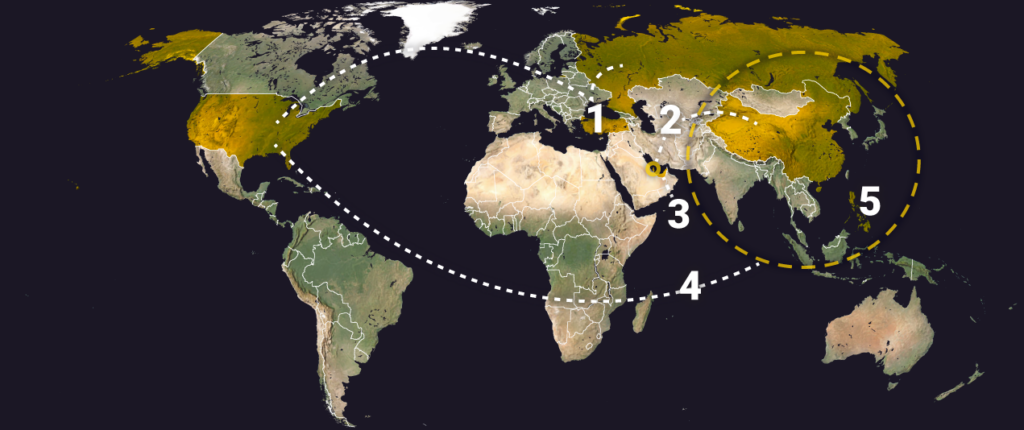

The Global Hotspot Tracker examines the outlook for key geopolitical hotspots around the world. (Go to the Global Connectivity Tracker)

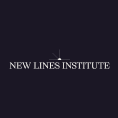

Middle East

Summary – Tensions in the Middle East trended toward military escalation and diplomatic de-escalation scenarios. Amid Israel’s preparations for its ground offensive on Rafah, al-Houthi rebels launched several attacks against merchant vessels and U.S. military assets in the Red Sea. U.S. Secretary of State Antony Blinken visited the region, and France made mediation efforts between Hezbollah and Israel.

Military escalation scenario

- Israeli Defense Forces struck targets in Khan Yunis and Rafah, while the Israeli air force hit the Nuseirat refugee camp.

Risk level – medium/high - Israeli Prime Minister Benjamin Netanyahu vowed to go ahead with the assault on Rafah, whatever the response by Hamas to the latest proposals for a cease-fire and a return of Israeli hostages.

Risk level – high - Israeli settlers attacked two Jordanian convoys carrying humanitarian aid for Gaza.

Risk level – low

Hybrid escalation scenario

- Al-Houthi rebels attacked several merchant vessels and downed a U.S drone while promising more attacks.

Risk level – low/medium - Turkey halted all exports and imports to and from Israel in response to the war in Gaza.

Risk level – low/medium

Diplomatic de-escalation scenario

- Israel’s war and security Cabinets are waiting for Hamas’ response to its truce proposal. Although Hamas initially indicated a negative response, it has clarified that the negotiations are a back-and-forth process.

Opportunity level – medium - French officials shared proposals with Lebanese authorities to defuse tensions between Israel and Hezbollah.

Opportunity level – low

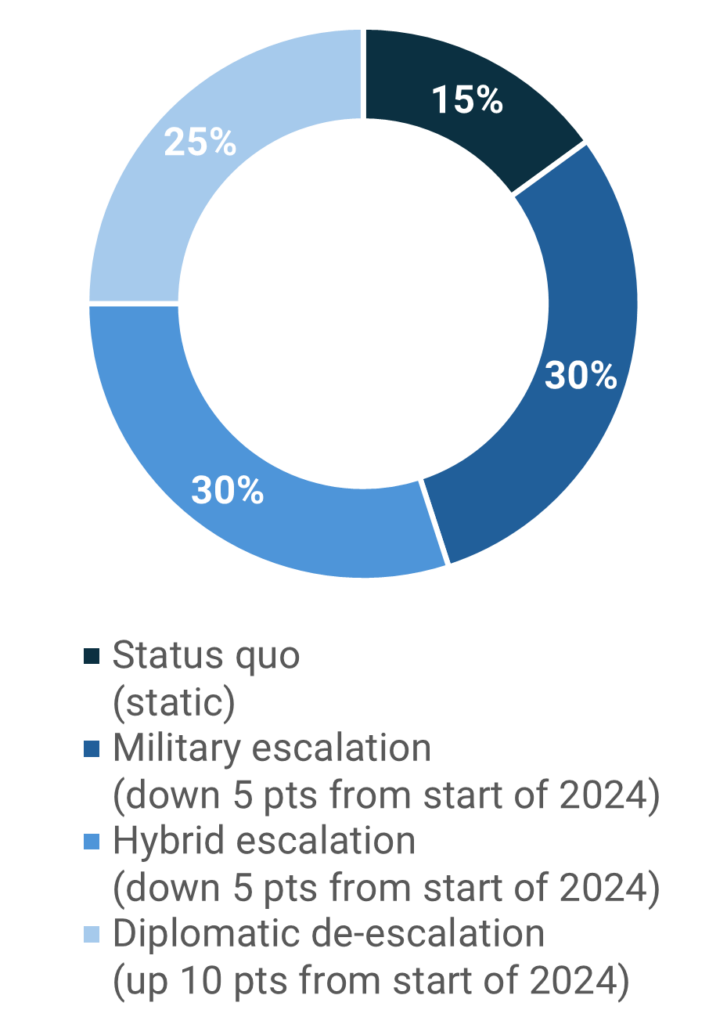

Russia/Ukraine Conflict

Summary – The Russia-Ukraine conflict is trending toward military and hybrid escalation scenarios. The Russian military made gradual advances in eastern Ukraine while conducting regular missile attacks against the cities of Kharkiv and Odesa, and Ukrainian forces await fresh weapons from a U.S. military aid package. The United States ramped up sanctions against individuals and entities linked to Russia’s war in Ukraine while moving to ban uranium imports from Russia. The Russian economy received a boost from people who returned to the country after fleeing in the initial wake of the invasion of Ukraine.

Military escalation scenario

- Russia made territorial gains in Eastern Ukraine, capturing several villages near Avdiivka and reaching the outskirts of Chasiv Yar, causing Ukrainian troops to retreat while Ukraine awaited fresh ammunition from the recently passed U.S. military aid package.

Risk level – medium - Ukraine fired U.S.-provided ATACMS missiles at Crimea to weaken Russia’s air defense capabilities, and the Pentagon said it would rush Patriot air defense systems to help Ukrainian forces.

Risk level – low - The U.S. accused Russia of having used chemical weapons against Ukrainian troops in violation of the Chemical Weapons Convention, according to a State Department report.

Risk level – low - Russian military personnel arrived at an air base in Niger that also hosts U.S. troops, though U.S. officials said they would be located in a separate hangar without intermingling.

Risk level – low

Hybrid escalation scenario

- The U.S. Senate voted to ban imports of Russian uranium to the United States, with Biden expected to sign the bill into law soon.

Risk level – low - Ukraine conducted a cyberattack against internet/mobile providers in the Russian region of Tatarstan.

Risk level – low

Diplomatic de-escalation scenario

- The upcoming First Peace Summit for Ukraine scheduled to take place in Switzerland June 15-16 will serve as a platform to achieve a “comprehensive, just and lasting peace” for Ukraine, according to Ukrainian President Volodymyr Zelenskyy’s press service.

Opportunity level – low - Kremlin Spokesman Dmitry Peskov said that any negotiations on the settlement of the Ukrainian conflict that do not include Russia are “absolutely impossible” to achieve results.

Opportunity level – low

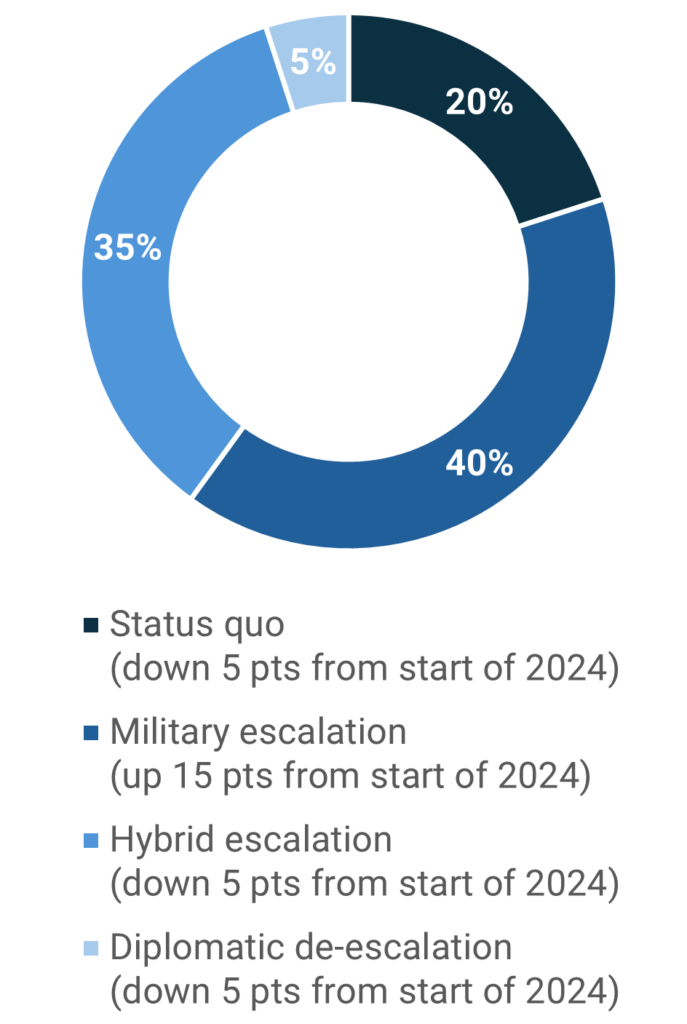

U.S./China/Indo-Pacific

Summary – Tensions in the Indo-Pacific trended toward both military and hybrid scenarios. The U.S. imposed sanctions on 20 Chinese and Hong Kong entities for allegedly supporting Russia’s military and energy industries. Additionally, the People’s Republic of China’s coast guard confronted Philippine and Japanese vessels in contested waters. This comes as South Korea raised its terrorism alert level, citing concerns that North Korea may target officials working at diplomatic missions in the region.

Military escalation scenario

- Tensions in the South China Sea between the Philippines and China continued to rise, after the PRC coast guard used water cannons while confronting Philippine vessels near the Scarborough shoal.

Risk level – medium - The Chinese coast guard confronted a Japanese research vessel carrying politicians and inspecting Japanese-administered islands in the East China Sea. The coast guard and the research vessel exchanged warnings, and China later filed a diplomatic complaint.

Risk level – low - South Korea raised the terrorism alert level for multiple diplomatic missions, citing intelligence that North Korea may look to harm officials at those locations.

Risk level – low - A top Taiwanese official noted the island was on alert for potential PRC military exercises around May’s presidential inauguration.

Risk level – low

Hybrid escalation scenario

- The U.S. imposed sanctions on 20 entities in China and Hong Kong accused of supporting Russia’s military industry and energy production.

Risk level – low - Taiwan’s King Yuan Electronic Co., which tests and packages semiconductors, has fully divested from its China-based subsidiary King Long Technology.

Risk level – low - The U.S. Federal Communications Commission will vote later this month on whether to ban Huawei and other companies that present national security risks from certifying wireless equipment.

Risk level – low - U.S. graphite miners have asked the U.S. government to impose higher tariffs on Chinese-sourced graphite products, arguing higher tariffs would counter the PRC’s monopoly over the key materials in EV batteries.

Risk level – low

Diplomatic de-escalation scenario

- No major indicators.

Global Connectivity Tracker

The Global Connectivity Tracker examines the impact of geopolitical dynamics on global energy security and the climate transition. (Go to the Global Hotspot Tracker)

Energy/Climate

- Turkey/U.S./Russia: Natural Gas

What happened: Turkey is considering a potential liquified natural gas (LNG) supply agreement with ExxonMobil in order to lessen its reliance on Russia.

Significance/Outlook: This new long-term contract between Turkey and U.S-based ExxonMobil could involve buying 2.5 million tons (about 3.5 billion cubic meters (bcm)) of LNG per year for a decade. In 2022, imports supplied most of Turkey’s natural gas needs, including supplies from Russia, Iran, Azerbaijan, the United States, and Algeria. Russia is by far Turkey’s biggest natural gas supplier. Energy security and independence from Russian natural gas are driving Turkey’s supply chain diversification.

Opportunity level – low/medium - Qatar/China: Natural Gas

What happened: Qatar signed a $6 billion shipbuilding deal with China, the country’s biggest LNG importer, to expand Qatar’s LNG capacity.

Significance/Outlook: QatarEnergy and China State Shipbuilding Corporation have agreed to construct 18 heavy LNG tankers as part of Qatar’s LNG production expansion program. The planned LNG expansion has elevated Qatar’s global market share to 30% in 2024. The vessels, expected to be delivered between 2028 and 2030, each will have capacity of 271,000 cubic meters and will be equipped with cutting-edge technology and environmental sustainability features. This deal, which is the largest in the industry, demonstrates Qatar’s commitment to bolstering investments in its LNG sector to meet rising global demand.

Opportunity level –medium/high

- United Arab Emirates: Nuclear Power

What happened: The United Arab Emirates will soon put out a tender for construction of a nuclear power plant to meet the future energy needs, effectively doubling the number of nuclear reactors now in operation there.

Significance/Outlook: When the Barakah facility in Abu Dhabi opened, the UAE became the first Arab state to operate a nuclear power plant. The plan is to have the new reactors operational by the year 2032 to meet the country’s projected energy needs. The UAE nuclear power program will reduce its oil dependence and the impact of climate change and fits within the UAE’s 2050 net zero ambition to dramatically enhance clean energy generation. Potential bidders for the new plants include the U.S., China, and Russia. This may cause issues with the U.S., considering its efforts to isolate Russia over the Ukraine incursion and its growing concerns about the Gulf states’ increasing connections with China.

Opportunity level – medium - U.S./Asia: Solar Power

What happened: U.S. solar panel manufacturers are petitioning the U.S. administration to impose import tariffs on products coming from Southeast Asia.

Significance/Outlook: Increased U.S. interest rates have led to solar manufacturing company stock crashes, bankruptcies, and plans for relocation. The issue has been amplified by the increased price of raw materials and the lack of potential jobs the industry could create for Americans. Despite subsidies provided by the U.S. government, the domestic solar manufacturing industry cannot compete with Chinese companies, as the cost-effectiveness and advanced technologies used by Chinese companies have allowed them to outperform and expand in the U.S. market. Chinese companies are also taking advantage of tax credits to open more manufacturing plants in the United States.

Risk level – low/medium - Philippines: Climate

What happened: Heat waves in the Philippines are putting pressure on power supplies, affecting daily life.

Significance/Outlook: The country’s weather agency is on alert as high temperatures are forecast to be near 100 degrees Fahrenheit in the coming days. Schools have closed and cases of heat stroke have risen around the country due to a combination of prolonged exposure, no air conditioners, and overcrowded classrooms. The heat wave is creating an additional strain on power supplies on the main island of Luzon, which contributes to three-quarters of the country’s economic production. According to the Philippines’ electrical grid operator, 13 power plants ceased operations earlier this month, with the number to increase if extreme weather conditions continue.

Opportunity level – low/medium

Key Stats of the Week

- The volume of solar panels imported from Southeast Asia, manufactured mainly by China-based companies, surpassed the volume of actual installations in the United States by more than 25 gigawatts (GW) last year.

- China-based companies are behind 5% of the roughly 80 GW in new module capacity announced since President Joe Biden signed the Investment Recovery Act in August 2022.

- The U.S. imports of solar panels grew 82% from 2022 and almost tenfold over the past five years. About 84% of the modules were supplied by Cambodia (11.6%), Malaysia (20%), Thailand (22.6%), and Vietnam (29.8%).

Source: https://www.rechargenews.com/energy-transition/us-factories-under-threat-from-unprecedented-wave-of-chinese-solar-panel-imports/2-1-1604599