The Weekly Forecast Monitor is a forward-looking assessment of geopolitical dynamics that are shaping the international system. To get more in-depth analysis of these issues and learn more about analytical products from New Lines Institute — including simulations, training sessions, and forecast reports — contact us at [email protected] and visit https://newlinesinstitute.org/analytical-products/. Download PDF version.

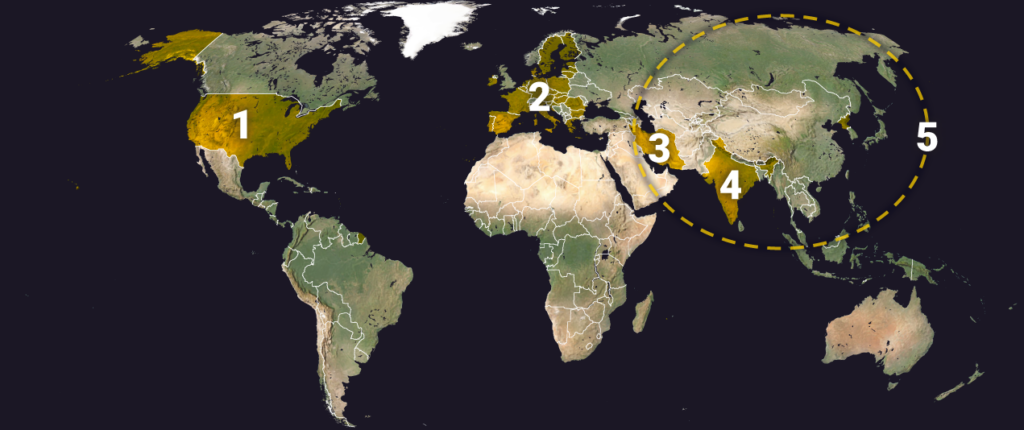

Global Hotspot Tracker

The Global Hotspot Tracker examines the outlook for key geopolitical hotspots around the world. (Go to the Global Connectivity Tracker)

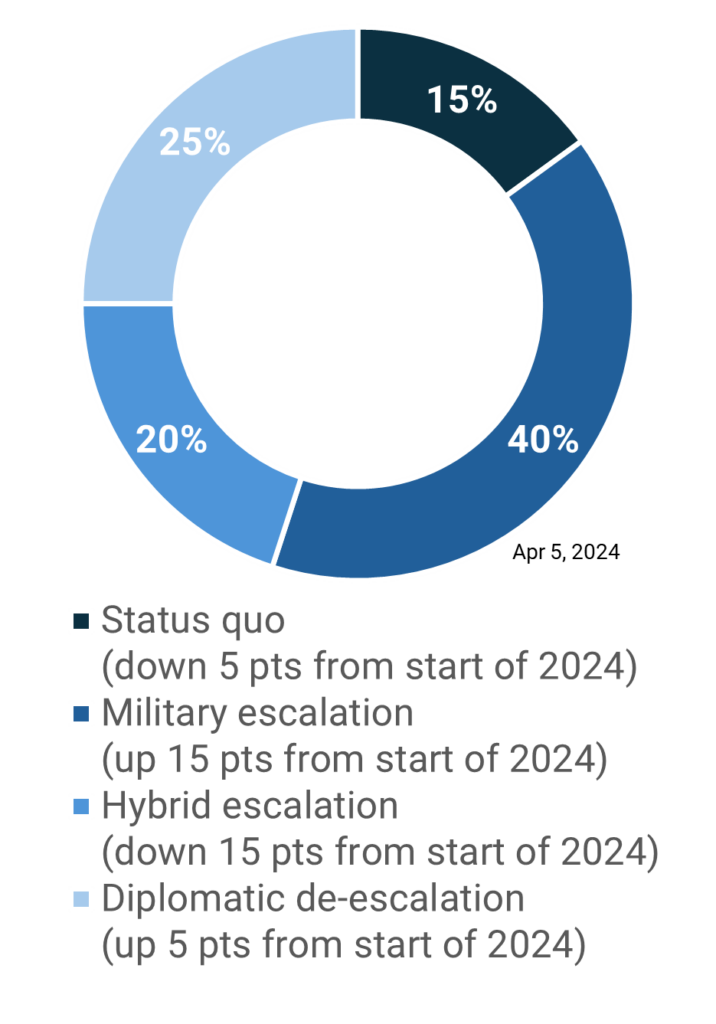

Middle East/North Africa Regional Tensions

Summary – Tensions in the Middle East trended toward a military escalation scenario after an Israeli strike killed two Iranian generals, including Gen. Mohammed Reza Zahedi, and other Islamic Revolutionary Guard Corps (IRGC) members at the Iranian consulate in Damascus. Iran vowed to retaliate against the attack, and Israel, expecting escalation, paused leaves for combat units. Meanwhile, diplomatic efforts to reach a cease-fire agreement between Israel and Hamas resumed in Cairo, but the two sides remain deadlocked.

Military escalation scenario

- Israel carried out strikes on Iran’s consulate in Damascus that killed multiple IRGC members, most notably Gen. Mohammed Reza Zahedi, a 30-year veteran of the IRGC and a key liaison with Hezbollah. Iran has vowed to punish Israel for the attack

Risk level – high - Israel paused combat unit leaves due to concern over escalating violence after Israeli attack on Damascus.

Risk level – medium/high - Senior Hezbollah commander Ismail al-Zin was killed by an Israeli strike in southern Lebanon.

Risk level – low - An Iran-backed Iraqi militant group struck an Israeli naval base in the southern port of Eilat, causing damage to a building.

Risk level – low

Hybrid escalation scenario

- The U.N. Human Rights Council is set to review a draft resolution that would call for an arms embargo on Israel on Friday.

Risk level – low

Diplomatic de-escalation scenario

- Cease-fire negotiations resumed this week and Israeli officials reported progress was being made; however, the two sides remain stuck on details of an agreement, including withdrawal of Israeli forces from Gaza and return of internally displaced Palestinians to northern Gaza.

Opportunity level – low

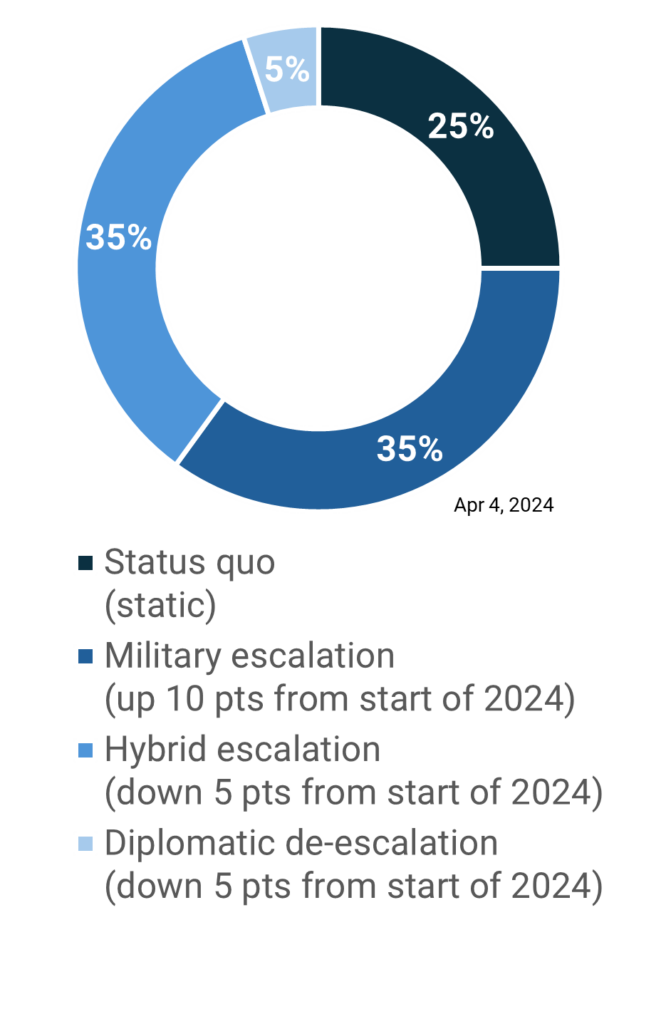

Russia/Ukraine Conflict

Summary – The Russia-Ukraine conflict is trending toward military and hybrid escalation scenarios as Russia increased its number of contract soldiers and is reportedly preparing a mobilization of 300,000 soldiers by this summer. Russia and Ukraine continued to attack each other’s energy infrastructure, with a Ukrainian drone attack hitting a refinery in Russia’s Tatarstan region far from the front line while a solar plant in Ukraine was targeted for the first time. NATO leaders discussed a “Trump-proof” fund to aid Ukraine for the next five years.

Military escalation scenario

- Russia’s Defense Ministry has pointed to an increase in contract soldiers to fight in the Ukraine war, with more than 100,000 people signing up so far this year.

Risk level – low - Ukraine claimed that Russia is preparing a mobilization of 300,000 additional soldiers by June 1.

Risk level – medium - Ukrainian President Volodymyr Zelenskyy signed into law the lowering of Ukraine’s military mobilization age from 27 to 25 after previously stating that an additional 500,000 soldiers are needed.

Risk level – low

Hybrid escalation scenario

- Over a million people in Ukraine were left without power following a Russian missile and drone attack, while Ukrainian grid operator DTEK reported 80% of its generating capacity was lost. In a separate incident, Russia targeted a solar power plant in Ukraine for the first time.

Risk level – medium - Ukrainian drones hit Russia’s third-largest oil refinery. The refinery in Tatarstan is 1,300 kilometers (800 miles) from the front, the deepest into Russia that Ukraine has hit so far. Russian gasoline production has fallen by 12% in the last week of March compared to the prior month.

Risk level – medium - Forty-four countries participated in the “Restoring Justice for Ukraine” conference, signing a declaration to create a tribunal that will investigate Russian war crimes.

Risk level – low

Diplomatic de-escalation scenario

- Russian Deputy Foreign Minister Alexander Grushko said dialogue between Russia and NATO is at its lowest point.

Risk level – low - Russian Foreign Minister Sergey Lavrov accused the West of ignoring peace initiatives led by China, South Africa, and the Arab League, claiming Ukraine’s “peace formula” does not involve compromises. Lavrov said China’s 12-point peace initiative was currently the most reasonable plan.

Risk level – low

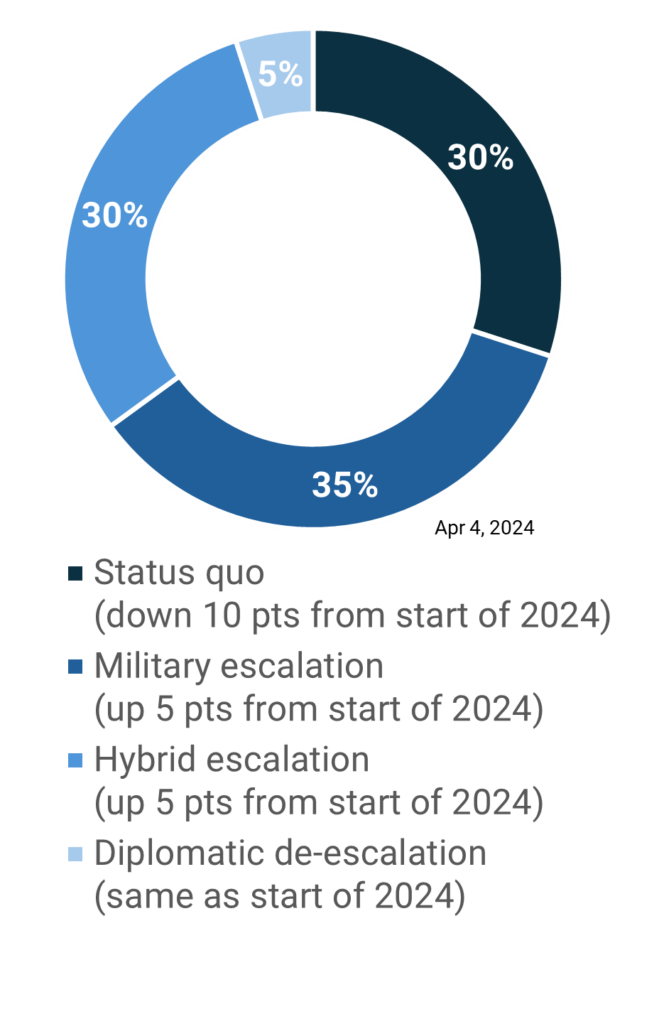

China/Taiwan/U.S. Tensions

Summary – While tensions between China and the Philippines in the South China Sea continued to trend toward military escalation, a series of diplomatic, economic, and security discussions between China and the U.S. took place this week in an attempt to ease tensions in the Indo-Pacific. Most notably, Presidents Joe Biden and Xi Jinping discussed a wide range of topics in a phone call, and Treasury Secretary Janet Yellen arrived in China to meet with her counterparts. Other high-level U.S.-China engagements are scheduled to take place in the month leading up to the Taiwanese presidential inauguration in May. While these engagements are unlikely to lead to de-escalation, they assist in maintaining the status quo in the Indo-pacific.

Military escalation scenario

- The Philippines stated it will continue its resupply missions to troops stationed at the Second Thomas Shoal and would respond to any attempts to disrupt those missions. This comes after two incidents in recent weeks of Chinese coast guard ships using water cannons to deter vessels from reaching the troops.

Risk level – medium - The U.S., Japan, and the Philippines are set to announce closer economic and security ties, including joint naval patrols in the South China Sea, at a trilateral summit next week.

Risk level – medium/low - Japan announced its guidelines for shelters in its southern islands near Taiwan. In the case of a military conflict in Taiwan, the shelters will be able to house residents for two weeks.

Risk level – low

Hybrid escalation scenario

- The European Commission is investigating whether Chinese-linked companies used government subsidies in a Romanian solar project, thus possibly “distorting the internal market” by undermining other project bids.

Risk level – low

Diplomatic de-escalation scenario

- Biden and Xi had a phone call to try to stabilize economic and security tensions. While the call did not result in any major breakthroughs, it did set the stage for further engagement between the countries and indicates the shared objective of avoiding escalation.

Opportunity level – low

Global Connectivity Tracker

The Global Connectivity Tracker examines the impact of geopolitical dynamics on global energy security and the climate transition. (Go to the Global Hotspot Tracker)

Energy/Climate

- United States

What happened: The Energy Information Administration warned that the suspension of marine traffic from Baltimore after the Francis Scott Key Bridge collapse may reduce U.S. coal exports.

Significance/Outlook: Baltimore managed 28% of U.S. coal exports in 2023, up from 25% the year before. The Francis Scott Key Bridge collapse will affect the coal miners’ export choices. India, Japan, China, South Korea, and the Netherlands may be affected by this closure and the reduction of coal exports from the US. Other energy products such as biodiesel, fertilizers (urea ammonium nitrate), and asphalt imported through Baltimore may also be affected by this closure.

Risk level – medium - European Union

What happened: The EU Critical Raw Materials Act (CRMA), passed by co-legislators from the European Parliament and Council last week, aims to diversify sources of critical raw materials.

Significance/Outlook: The CRMA sets high targets for the EU’s use of strategic raw materials by the end of the decade. No single non-EU country should supply more than 65% of the EU’s yearly use of any such substance. EU imports from China exceeded this barrier for bismuth, manganese, magnesium, cobalt, and strontium (99% on rare earths materials from China), The EU also exceeded the barrier for Turkish borates and feldspar (90% of boron) and U.S. beryllium imports. The CRMA will guarantee EU access to secure and sustainable key raw materials, helping Europe reach its 2030 climate objectives.

Opportunity level – low

- Iran

What happened: Iran’s oil exports continue to rise, contributing to the country’s positive trade balance.

Significance/Outlook: Iran’s oil exports grew roughly 50% in 2023 to a five-year high of about 1.29 million barrels per day. The exports have mitigated the effects of the Middle East conflict on oil prices but have raised concerns about Iran’s evasion of U.S. sanctions. Chinese purchases of Iranian oil have allowed the country to maintain a positive trade balance according to Mohammad Rezvanifar, Iran’s head of Customs. Growing oil demand in Asia will likely lead to an increase in oil shipments from Iran, calling into question the efficacy of U.S. sanctions on the energy sector.

Risk level – low - India

What happened: India is aiming to enhance its energy transition endeavors by investing in lithium and copper assets abroad.

Significance/Outlook: India has significantly intensified its efforts to shift away from reliance on fossil fuels. This is evident in the government’s increased investments in critical minerals that are essential to modern-day technologies, including renewable electricity, batteries, and EVs. There is a specific focus on copper and lithium, which India is interested in precuring more of from Chile and Argentina, which are top producers of both. This step will likely take India in the right direction as both government and private companies’ involvement will improve synergy and policy implementation and help achieve India’s transition goals in the long run.

Opportunity level – medium - Asia

What happened: Imports of LNG into Asia reached a record high, after low demand in Europe helped push prices down.

Significance/Outlook: LNG is becoming a more attractive fuel for large Asian buyers, like China and India, whose fast-growing emerging markets have strongly contributed to LNG growth. Other developing Asian economies such as Thailand expect to have continuous population growth which supports further electrification in the region. The growing demand will create opportunities for natural gas growth, especially as industrial coal-to-gas switching gathers peace in Asian countries. What adds to the LNG growth in Asia is high gas storage levels and lower demands in Europe that helped reduce the risk of physical gas supply shortages in the winter season.

Opportunity level – medium

Key Stats of the Week

- Baltimore exported 19 million tons of high-heat steam coal in 2023, mostly to India (13.5 million tons). The rest was exported to the Netherlands, the Dominican Republic, Canada, Egypt, and other countries. In 2023, Baltimore exported 9 million tons of metallurgical coal to Japan, China, Brazil, Netherlands, South Korea, and others.

Source: https://www.reuters.com/world/us/baltimore-port-closure-could-dent-us-coal-export-volumes-eia-says-2024-03-28/